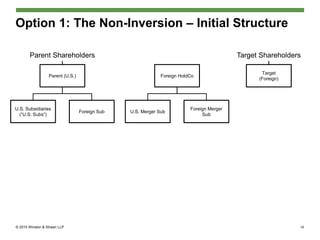

Grant Thornton LLP. All rights reserved. Corporate Inversions A primer on inversion strategies and the U.S. tax landscape Disclaimer Opinions and views. - ppt download

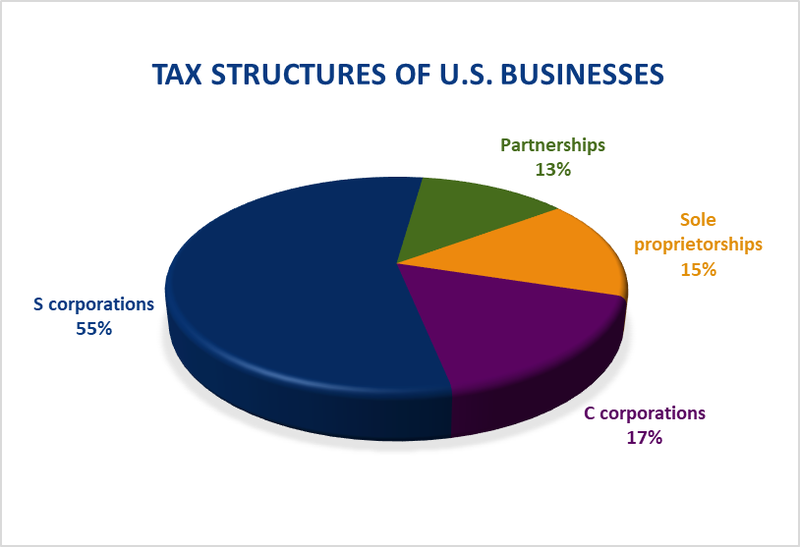

New Tax Forms Required for Many Partnerships & S-Corporations: Introducing Schedules K-2 and K-3 | Marcum LLP | Accountants and Advisors

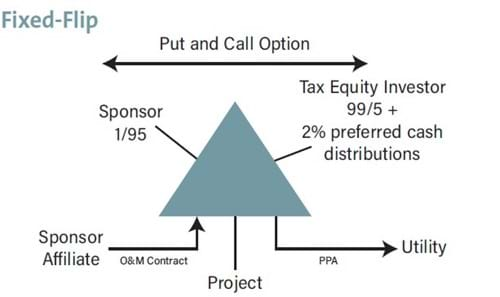

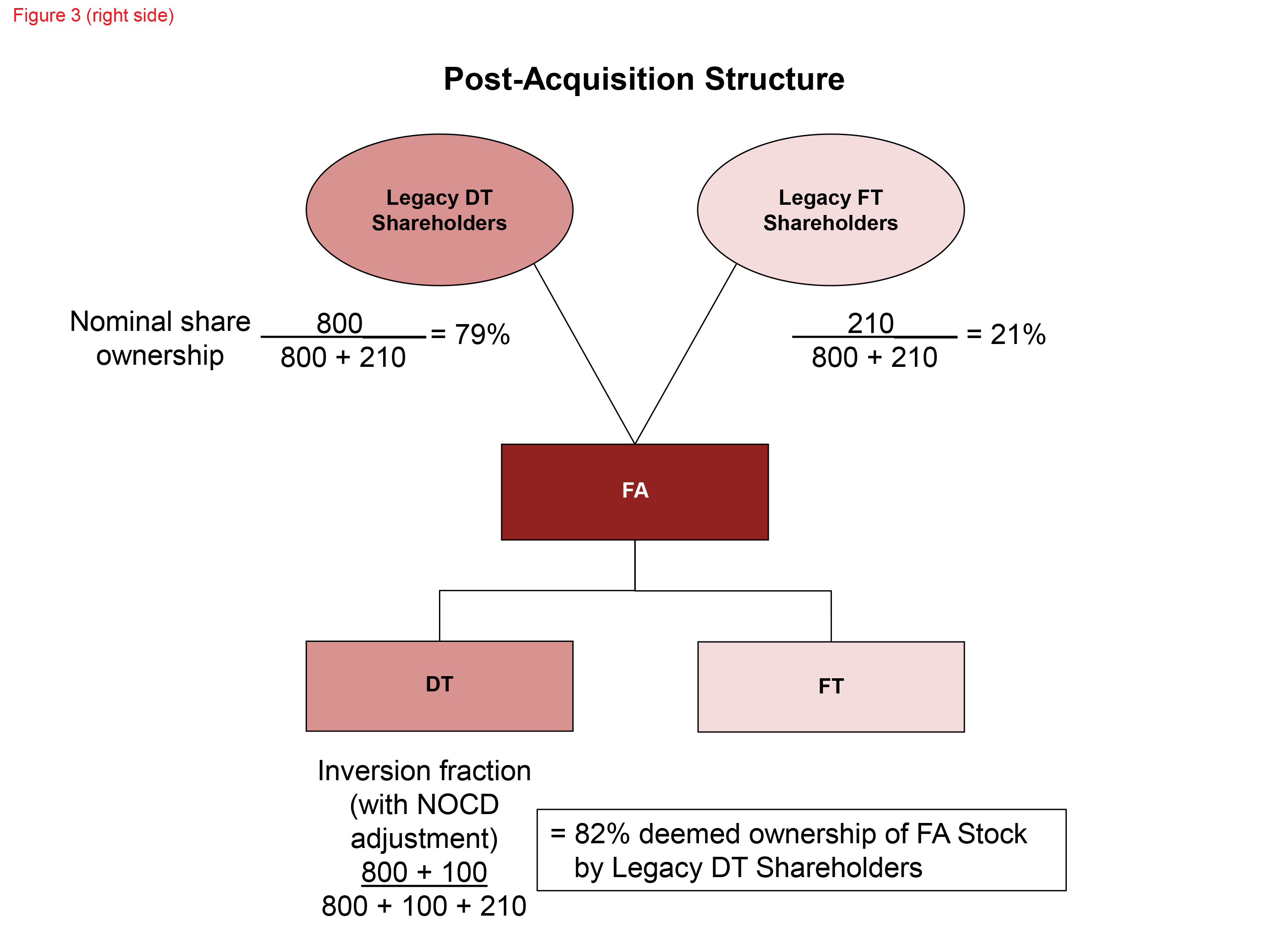

Grant Thornton LLP. All rights reserved. Corporate Inversions A primer on inversion strategies and the U.S. tax landscape Disclaimer Opinions and views. - ppt download

Grant Thornton LLP. All rights reserved. Corporate Inversions A primer on inversion strategies and the U.S. tax landscape Disclaimer Opinions and views. - ppt download